(Kitco News) – Silver is struggling to hold its ground at $39 an ounce, but after seven years of supply deficits, the precious metal remains in a solid uptrend, according to one market strategist.

Maria Smirnova, Senior Portfolio Manager and Chief Investment Officer at Sprott Asset Management, said in her mid-year silver outlook that the silver market may be poised for a sharp upside in the second half of the year due to solid demand and significantly diminished supply.

The comments come as silver prices have already seen robust gains in recent months, even outpacing gold’s performance. Spot silver last traded at $39.05 an ounce, down 0.57% on the day; however, the precious metal is up nearly 35% since the start of the year.

Meanwhile, gold last traded at $3,373.50 an ounce, up 28.5% year-to-date.

“We believe the catalysts for this silver bull market are a structural supply deficit, growing industrial demand, and renewed investor interest, particularly among Asian and North American retail buyers of exchange-traded products, coins, and bars,” she said in her report.

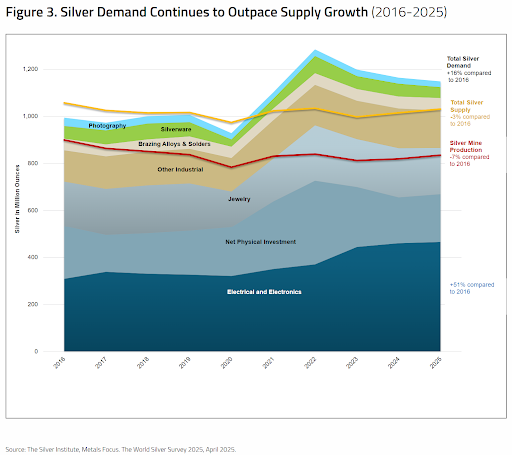

Industrial demand has been a critical factor behind silver’s growing deficit, and Smirnova said she doesn’t expect this trend to reverse anytime soon. Since 2016, total global silver demand has grown by 16%, while mine production has fallen by 7%.

In this environment, Smirnova said the precious metal’s near-term potential could depend on retail demand, which remains the wild card in the marketplace.

“The available inventory of freely traded silver has been heavily diminished, making the metal more sensitive to incremental buying,” she said. “Small increases in demand could now lead to disproportionately large increases in price. With less silver available for open-market trading, investor positioning has become a more decisive force in price movements.”

While silver has outperformed gold in recent months, Smirnova noted that gold’s premium remains overextended. The gold-silver ratio has dropped to 86, down sharply from the highs above 100 seen in April. However, the ratio’s historical average hovers between 50 and 60.

Smirnova said that this positioning still makes silver an attractive value play for retail investors.

“Silver is regaining prominence as a trusted safe-haven asset in today’s environment of increased geopolitical tensions, inflationary pressures, and financial market instability. Historically, silver has served as a store of value in periods of crisis, much like gold, but with the added benefit of being significantly more affordable and accessible for retail investors,” she said. “With supply deficits deepening and demand intensifying across both industrial and investment channels, silver’s bull market appears well supported. We believe silver offers an attractive opportunity for investors seeking exposure to a hard asset with both growth and defensive qualities.”

As for silver’s potential upside, Smirnova noted that historically, in a precious metals bull market, silver’s rally has, on average, been twice as large as gold’s.

“This past outperformance is due in part to silver’s smaller market size and higher volatility, which amplifies price movements, and silver’s dual role as both a monetary and industrial metal, which adds extra demand,” she said.